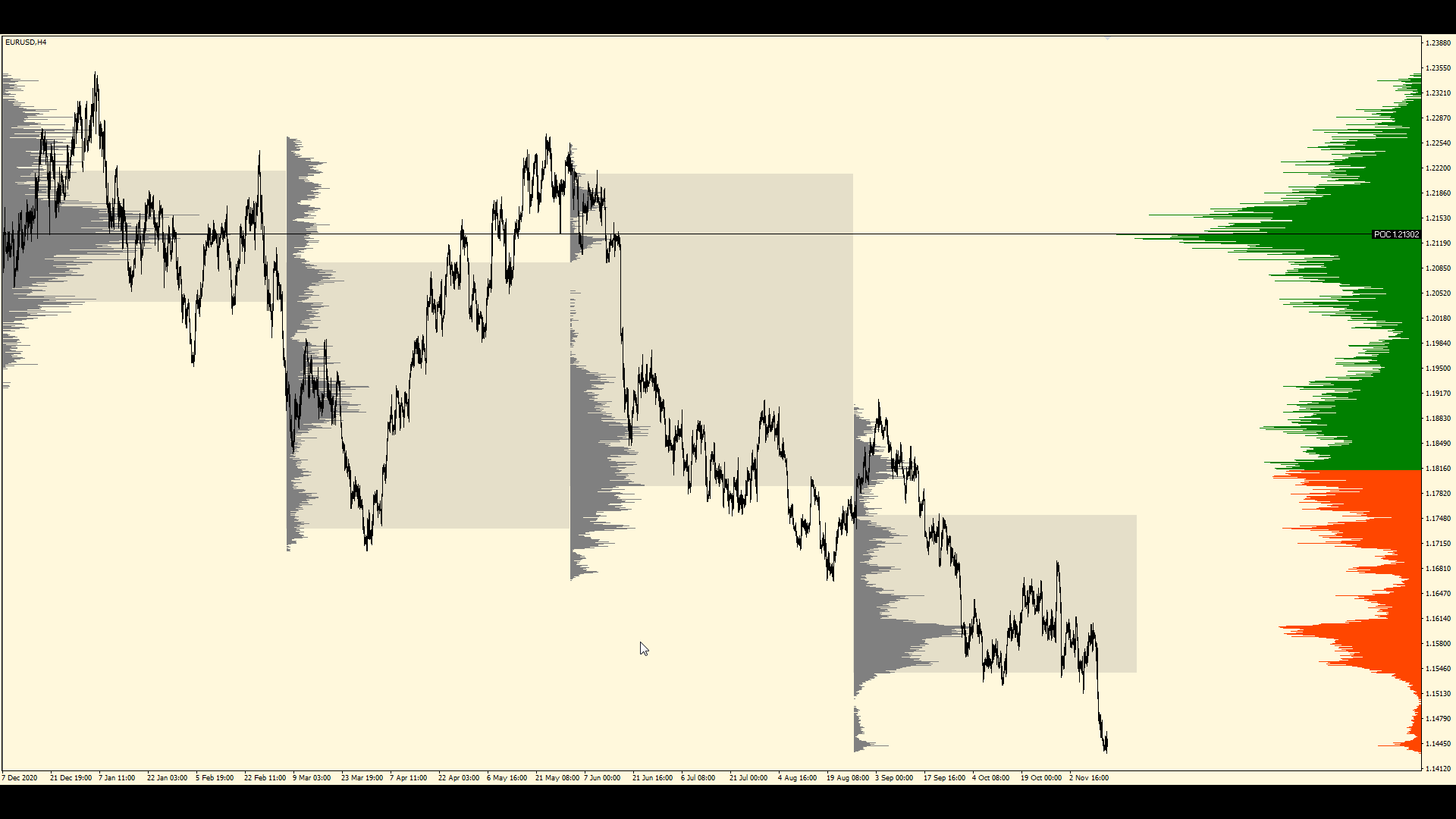

Volume Profile histogram. First instance segmentation by divisor. Second instance window anchored composite. High resolution level size. Histogram sizes relative to segment with highest price level volume. Value Area (VA) indication on object. Volume Point of Control (VPOC) indication by line. Composite instance with line indication label. Value Area indication on range background, on object disabled. Increased range division and Value Area indication on range background with ray style extending indication to the right side of the chart.

Chart Template Documentation

Note: This chart template has a relative range selection and segmentation method setting, the range updates on scroll, change with the Dataset Range and Dataset Segment parameters.

General disclosure: Materials, information, and presentations are for software feature educational purposes only and should not be considered specific investment advice nor recommendations. Risk disclosure: Trading currencies, equities, indices and commodities involves substantial risk of loss and is not suitable for all investors. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security nor life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.